Frozen Residential Property Market Won’t Thaw Until Rates Come Down

Summary: Yesterday, I posted a piece arguing the Fed rate hike was a mistake and inflation and rates are headed down from here. Rate hikes don’t work by gradually curbing spending; they work by freezing asset markets dead in their tracks. The best example today is the residential property market where 7% mortgage rates have made buying a home unaffordable for most people at anything near recent home prices. It will take substantial cuts in rates to thaw the market.

How Do Interest Rate Hikes Work?

The most important question after this week’s Fed announcement is not “What will be the effect of another quarter-point rate increase?” If they haven’t already killed the inflation zombie with the 20 quarter-point bullets they have already fired into it, the twenty-first bullet isn’t going to do the job.

Fact is, nobody knows what the effect of a 1/4% change in interest rates will be. In the models the Fed uses to forecast the economy, an interest rate increase works by convincing consumers to work a little harder this year and to defer spending some of their income until next year. (Economists call it an Euler equation—the first equation in every DSGE model.) But when I asked each of my 6 children and 4 grandchildren which purchases they had decided to defer based on Wednesday’s rate decision, they made snorting sounds and told me they’d get back to me after they had finished going through the math.

The second way an interest rate increase works in the textbooks is by convincing corporate managers and boards of directors to cancel capital spending plans. That doesn’t work in the real world either, both because real boards of directors won’t approve a capital spending project unless the projected return is about double the cost of money anyway and because it takes a long time to get a capital spending project approved and an even longer time to complete it. Nobody is going to mess with ongoing projects for a 1/4% rate increase.

So, how do higher rates actually work in the real world? IMHO, there are two principal ways. One is through the impact of mortgage rates on housing prices. The second is by triggering a cascading network failure in the credit markets that shuts down bank lending and makes it impossible for businesses to borrow the working capital they need to make payroll.

Unaffordable Mortgage Rates, Frozen Transactions

The first of these has already happened. Mortgage rates are already 7%, somewhere between double and triple the rates at which we were refinancing our homes just two years ago. That 7% has already effectively frozen the residential property market in place; another quarter point won’t change anything.

When I say residential property market, I mean existing homes, not new homes, because there are so many of them. The most recent Census data shows there were 144 million existing homes at the end of last year, which makes 96 existing homes for each of the 1.4 million new homes built last year, implying that the total stock of housing units grew by a little under 1% last year. These numbers mean that the housing market is an asset market (measured at a point in time), not a product market (measured by unit produced per period of time). For all practical purposes, the supply of houses is fixed, i.e., there will be 144 million houses tomorrow too. As it true in every other marker, all 144 million homes have to be owned by somebody all of the time. The only question is what price will make people want to own them. This means that home prices are entirely determined by demand to hold them, not to buy and sell them, which is influenced by mortgage rates and by the expected net return on houses and all other assets.

Contrary to a lot of thinking, high mortgage rates don’t affect the economy the way many people think they do by increasing people’s mortgage payments and forcing them to buy fewer tennis shoes or spend less at the grocery store. High mortgage rates work by shutting down transactions and freezing the property markets in their tracks.

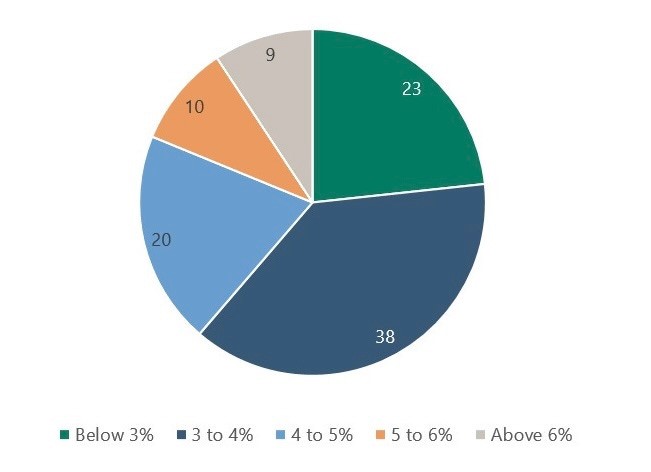

Share of Outstanding Mortgages by Interest Rate

Here’s why. According to data in The Urban Institute’s Housing Supply Chartbook, about two-third’s of homes are owner-occupied, and one-third are occupied by renters. One-third of owner-occupied homes are owned free and clear with no mortgage at all. Of those with mortgages, 61% (the green and blue slices added together in the chart above) have a mortgage rate below 4%, 81% have a mortgage rate below 5%, and 91% have a mortgage rate below 6%, still far below today’s 7% mortgage rates..

As a result, a hike in mortgage rates from today’s 7% to 7 1/4% will have no impact at all on the cash flow of most home owners, but it does effectively lock them into their homes because mortgages are not assumable by a new buyer as they were once upon a time (before the S&L crisis more than 40 years ago.)

It makes no sense for most existing home owners to move. Were they to sell their current house carrying a 3% mortgage rate and buy another house at the same price and the same mortgage balance financed at today’s mortgage rates, their monthly house payments would more than double. To do so would amount to a huge gift to the existing lender, who could resend the balance at current rates and more than double their cash flow. As a result we see very few transactions taking place at today’s rates reflecting the huge gap between recent prices and the prices at which new buyers could afford to buy and finance a home at today’s mortgage rates.

Another way of saying this is that the shadow price of a house—the price at which the market would clear at today’s mortgage rates—is far, far below current home prices. (I’m not going to give you a figure for this out of fear that it would trigger a wave of heart attacks among my readers. I need all the readers I can get!)

Clearly, this situation is not sustainable. If interest rates were to remain at or above current levels indefinitely, home prices (and the value of securities that hold them as collateral) would have to decline sharply from today’s levels—in the year before a national election! More likely, the gradually falling inflation data, along with rising damage to the economy from tight the credit markets that Chairman Powell was so proud of, will compel the Fed to reduce rates.

No Credit Crisis Yet

What about the second way rising interest rates impact the economy, by triggering a credit crisis? Credit crises—like the Dotcom crisis or the subprime debt crisis—work by shutting down bank lending.

By credit crisis, I am not referring to the gradual tightening of credit conditions that Chairman Powell talks about. I mean a sudden shift from a normal price-clearing credit market to a state of non-price rationing where it is not possible for businesses to borrow the working capital they need to make payroll from their bank at any price.

So far, the Fed has dodged a legitimate credit crisis, although they flirted with one in March when they learned their aggressive rate hikes had reduced the value of Treasuries and mortgage bonds by enough to wipe out the equity capital of most regional banks. Emergency actions by the Fed and Treasury to extend deposit guarantees and flood the market with liquidity kept the situation from morphing into something more serious. But banks still hold the underwater securities on their balance sheets and money market funds still pay 5% more than checking accounts so don’t exhale just yet.

Where are we today? We are not in a credit crunch yet, which is why the product and labor markets are still working. Banks are still lending and credit markets are still mostly open. But credit is very, very tight, whether you measure by the number of lenders that are eager to bid on a piece of financing, by borrowing costs (interest, fees, equity kickers), or by non-price baggage (required interest caps, credit guarantees, collateral haircuts, or trip-wire covenants). And we still have to work our way through the repair of underwater regional bank balance sheets and the refinancing of a lot of office buildings in the next two years. That makes credit markets extremely susceptible to damage from further rate hikes.

These conditions make me want to have an unusually large amount of liquidity on hand along with a plan to deploy that liquidity as a hard-money lender if things should go wrong.

Dr. John

The views and opinions expressed in this article are those of Dr. John Rutledge. Assumptions made in the analysis are not reflective of the position of any entity other than Dr. Rutledge’s. The information contained in this document does not constitute a solicitation, offer or recommendation to purchase or sell any particular security or investment product, or to engage in any particular strategy or in any transaction. You should not rely on any information contained herein in making a decision with respect to an investment. You should not construe the contents of this document as legal, business or tax advice and should consult with your own attorney, business advisor and tax advisor as to the legal, business, tax and related matters related hereto.