Raising Interest Rates and Selling Bonds.

Summary (January 9, 2022): Now that the Fed has shown that it can at least talk tough, the speculation has started about just when they will end Quantitative Easing (QE), when they will start Quantitative Tightening (QT), and when they will start to raise interest rates. I thought it would be a good time to explain why QE/QT and lowering/raising interest rates are not separate policy choices. They are exactly the same thing. That’s because, to a first approximation, an interest rate is just the inverse of a bond price. As a result, the principal impact of Fed policy is on asset prices and net worth, not on GDP. Failure to recognize this has contributed to the widening inequality issue that has made political differences so divisive today.

Interest rates are, perhaps, the most important concept in macroeconomics and finance. Unfortunately, many students get their degrees without knowing just what an interest rate is. That’s why the first thing I do on the first day of my macroeconomics class is to show the students the following graphs.

A bond is just a fancy name for an IOU. The piece of paper pictured above is a bond–an IOU written by Uncle Sam promising that the US Treasury Dept. will pay the owner $100 at a certain date in the future. The one pictured, above, is for $100 but for our illustrations we are going to pretend the IOU is for $1.00 and that date the IOU comes due–its maturity date–is one year from today. Whether it was written by Uncle Sam, by a corporation, or by your cousin Wally, a bond is still an IOU.

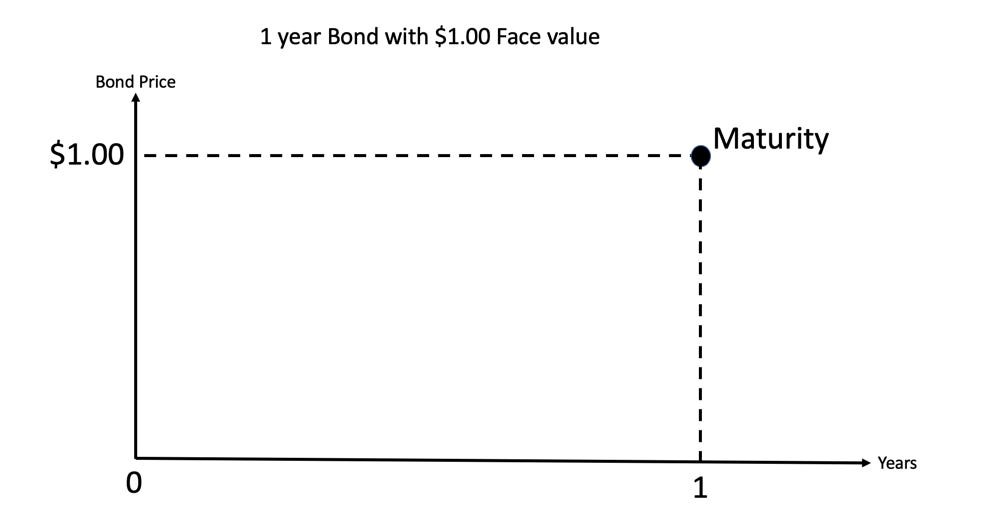

The graph above tells you that you only know one thing about the IOU; it is a promise to pay you $1.00 in exactly one year.

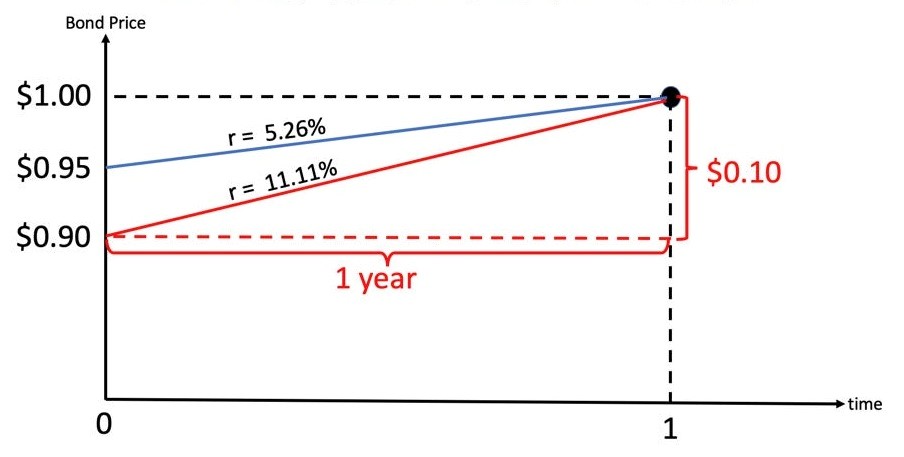

The bond price tells you how much the IOU is worth today. In most situations it wouldn’t be a good idea to pay Uncle Sam $1.00 for the IOU because then he would get to use your money for a year for free. So, let’s say that, to entice you and others to buy the IOUs Uncle Sam was only able to sell them for $0.95 for each dollar promised a year from now. As you can see in the graphic below, if you pay $0.95 today and Uncle Sam pays you $1.00 in one year, you will have made a profit (return) of $0.05 for each $0.95 you paid. The interest rate is nothing more than a shorthand for describing that situation. In this case, your $0.05 profit is 5.26% of the $0.95 you paid, i.e., the interest rate is 5.26%.

Let’s say that one New York Minute after you paid $0.95 for your IOU you learn that the going price for IOUs had changed to $0.90, i.e., the interest rate has increased to 11.11%. Bummer, right? That could have happened for any number of reasons. The Treasury might have sold more IOUs than people had thought they would. Someone else (like the Fed or the Chinese government) might have sold a truckload of them. Or people could have just decided they want to spend their money now, rather than a year from now because they learned that a giant comet was going to strike the earth in six months from now. Whatever the cause, it’s not good for you. Sure, you can still sell it back to the Treasury in one year for $1.00 (except for the comet thing). But every day between now and then, the price you could sell it for is now less than it would have been if interest rates had stayed at 5.26%.

So, the price of the IOU and the interest rate on the IOU both represent the same piece of information. The sloppy language of the textbooks and policy papers suggesting that the Fed changes the interest rate, which then somehow influences bond prices through some causal mechanism, is misleading. The bond price is the interest rate and vice versa.

To a first approximation, the only tool the Fed, or any other central bank has, is the size of its balance sheet, i.e., how many bonds they own. That means that, to a first approximation, the only thing the Fed directly influences is the price of those bonds. When they buy, say, $1 trillion worth of bonds, the direct impact is to raise the price of the particular types of the Treasury bonds or Mortgage-Backed Securities they buy.

Or, you can describe this as a fall in interest rates on those securities, both absolute and relative to the prices/yields on other assets. The relative decline in yields will induce investors to sell some of them in favor of other, higher-yielding close substitutes. In this way, the direct impact on yields of Fed purchases–we call it Quantitative Easing today–will disperse across the asset markets, like ripples on a pond. (The equations that describe this phenomenon in thermodynamics are called dispersion equations.)

But what about GDP, the economy, incomes, output, and employment? About two-thirds of GDP is made up of services. The ripples on a pond story isn’t as convincing with haircuts or guitar lessons as it is with bonds, mortgages, stocks, and even houses. This makes Fed policy a blunt instrument for controlling GDP, jobs, consumer prices, or wages. Unfortunately, that is not the view of the policy crowd or the Fed staff who think they can produce GDP by buying bonds.

The upshot of this misunderstanding is to worsen the inequality issue that has torn the political system apart. It is not the difference between high-income and low-income workers that is the problem. It is the difference between the paths of the net worth economy, the people whose economic welfare depends on asset prices, and the paycheck economy, the people whose welfare depends on weekly paychecks. The recent shift of Fed policy toward ease will keep those trends in place for a long time.

I will write a separate piece digging into the investment implications of continued divergence between the net worth economy and the paycheck economy. The high-level implications are easy: businesses that make their money delivering products and services to people, industries, and geographies in the net worth economy will grow faster than their counterparts in the paycheck economy. The implied continued widening of the gap between living standards suggests that the political environment is likely to get even more unstable. I will write more on this in the coming days.

Dr. John

The views and opinions expressed in this article are those of Dr. John Rutledge. Assumptions made in the analysis are not reflective of the position of any entity other than Dr. Rutledge’s. The information contained in this document does not constitute a solicitation, offer or recommendation to purchase or sell any particular security or investment product, or to engage in any particular strategy or in any transaction. You should not rely on any information contained herein in making a decision with respect to an investment. You should not construe the contents of this document as legal, business or tax advice and should consult with your own attorney, business advisor and tax advisor as to the legal, business, tax and related matters related hereto.