How to Think About Recession and Financial Crisis

Summary: I posted these charts several months ago with a promise that I would write more to explain them. Well, I got distracted and didn’t do so even after a request from one of the best economists I know. I am posting it again and will write more tomorrow to explain it. It is the way to think about financial crises as phase transitions. I think it is the explanation for the impact of the coronavirus on the economy. We are suffering a cascading network failure. More below.

Nerd Alert

I want to warn you that this is a seriously nerdy piece so don’t blame me if you stare at it for a long time and suffer brain damage as a result.

Long ago I was a tenured Professor. Then I got bored and wandered off to do strange things. I advised governments, pension funds and big investors, helped restructure companies, started a mutual fund, founded a private equity firm, served on the boards of dozens of public and private companies, and got about 20 million air miles.

Then I started teaching PhD students again. What I saw being taught as macroeconomics blew my mind–and not in a good way. Here is a peek at how I teach it.

Far From Equilibrium Economics

I still loved working with the students, which was the reason I started teaching in the first place. But I found that what passed for state-of-the-art thinking in both macroeconomics and finance made no sense to me at all. So I taught the stuff to the students, then taught them what was wrong with it, and finally taught them a framework I had developed over the previous 30 years that I think of as far-from-equilibrium economics to help understand what goes wrong when an economy falls out of textbook full-employment general equilibrium into financial crisis and ultimately fights its way back to health again.

Financial Crises as Phase Transitions

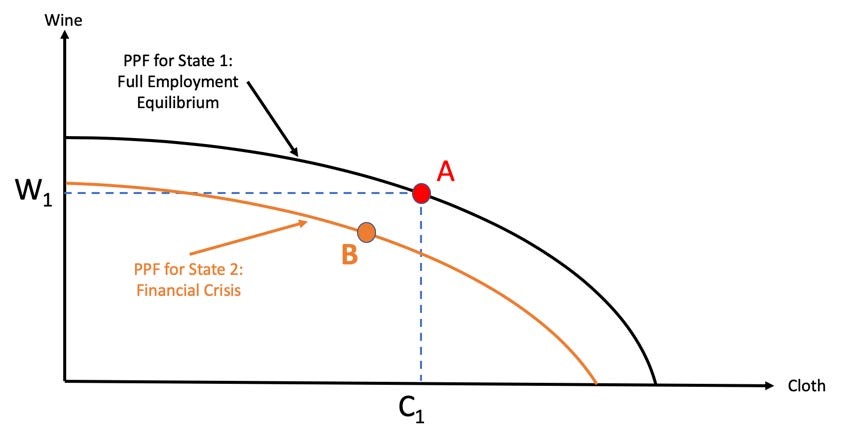

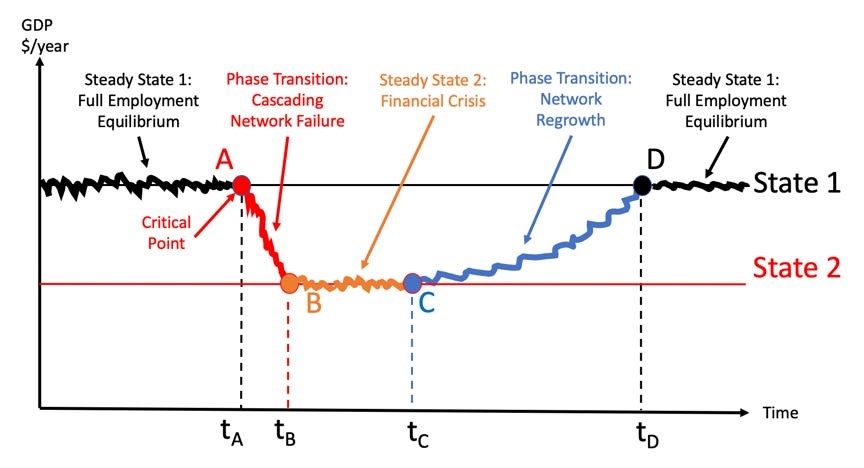

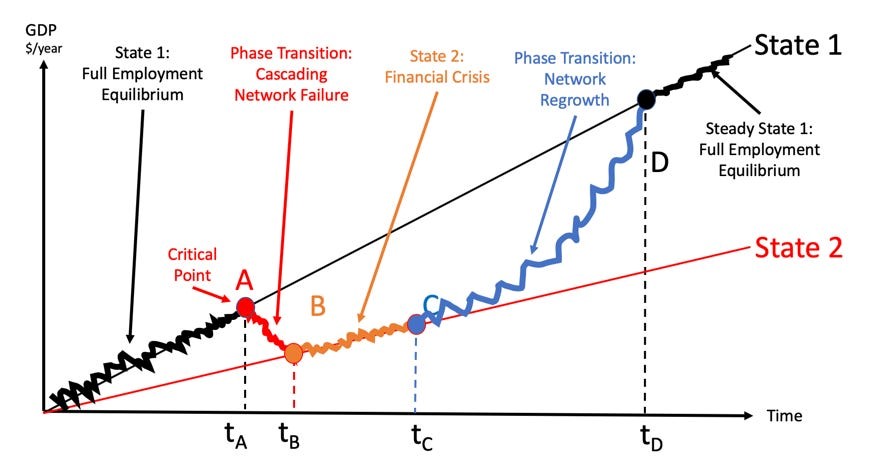

It’s a complicated story that requires understanding some unfamiliar ideas drawn from unfamiliar literature so I’m going to tell it bit by bit. In this piece I am only going to give you a few of the key summary graphs showing an economy initially cruising along at full employment, hit by a sudden financial crisis (something we will later call a cascading network failure), experiencing a phase transition to a recession state, eventually fighting its way back to general equilibrium as the network recovers.

The graphs, below, are the summary of the ideas we will develop in further posts. I hope to convince you that they represent a much more fruitful approach to macroeconomics and finance than the stuff currently described as accepted wisdom. I will also write about the investment strategies that make sense in this view of the world.

Needless to say, more to come.

Dr. John

The views and opinions expressed in this article are those of Dr. John Rutledge. Assumptions made in the analysis are not reflective of the position of any entity other than Dr. Rutledge’s. The information contained in this document does not constitute a solicitation, offer or recommendation to purchase or sell any particular security or investment product, or to engage in any particular strategy or in any transaction. You should not rely on any information contained herein in making a decision with respect to an investment. You should not construe the contents of this document as legal, business or tax advice and should consult with your own attorney, business advisor and tax advisor as to the legal, business, tax and related matters related hereto.